A Global Outlook by The Immigration Magazine

Global economic growth in 2025 tells a story of two worlds. On one side, emerging markets across Asia, Latin America, and Africa are surging ahead, reshaping trade routes, attracting foreign direct investment (FDI), and setting the tone for the next decade. On the other hand, advanced economies in Europe and North America are losing steam, weighed down by aging populations, high energy costs, and sluggish demand.

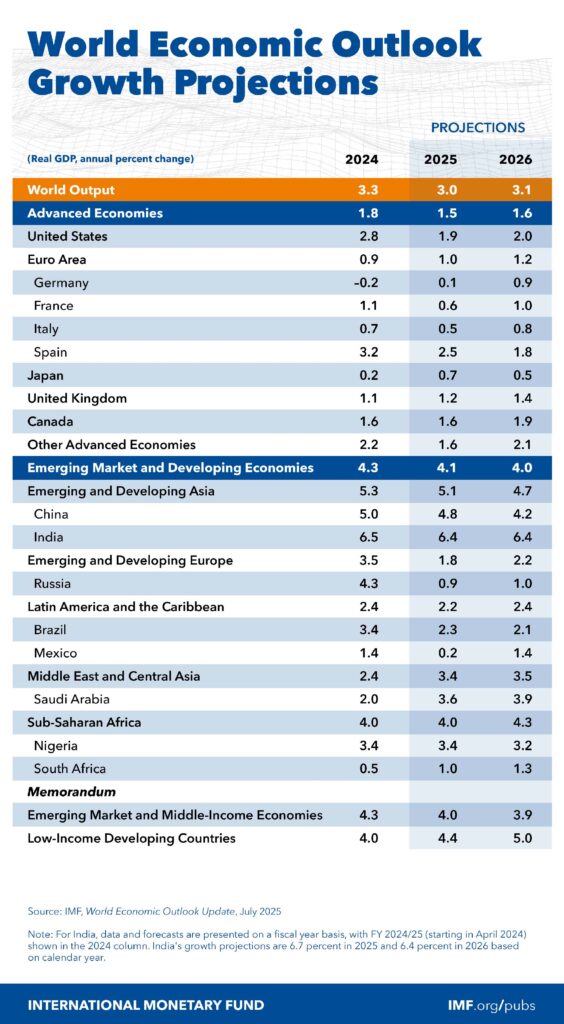

According to the IMF World Economic Outlook (April 2025) and its July 2025 update, global GDP will expand by 3.0% in 2025 and 3.1% in 2026. The World Bank’s Global Economic Prospects echoes this, emphasizing that the balance of growth is shifting decisively toward emerging and frontier markets.

For readers of The Immigration Magazine: investors, policymakers, and globally mobile families, these numbers are more than statistics. They highlight where opportunity lies and where the future of Residency and Citizenship by Investment (RCBI) will be shaped.

Emerging markets lead global economic growth in 2025, reshaping investment and mobility opportunities.

India: The Relentless Engine of Global Growth

India continues its extraordinary rise, with the IMF projecting 6.4% GDP growth in 2025, the fastest among all major economies. With a population exceeding 1.4 billion and a digital economy expanding at record speed, India is not only a manufacturing powerhouse but also a leader in technology services, fintech, and infrastructure investment.

FDI inflows are breaking records as multinationals pivot from reliance on China to a diversified Asia strategy. For investors seeking both growth and scale, India is the undisputed destination of this decade.

Argentina surprises with 5.5% GDP growth in 2025.

Latin America’s Revival: Argentina and Beyond

Few would have predicted that Argentina would share the second spot globally, with 5.5% growth in 2025. Years of turbulence are giving way to cautious optimism as reforms stabilize markets and exports, particularly in agriculture, strengthen.

Elsewhere in the region, Brazil (2.3%) and Colombia (2.5%) offer steady, if unspectacular, growth. Still, as the World Bank notes, Latin America is carving out a new role as a hub for renewable energy, agri-business, and real estate investment.

For global citizens, this also means a renewed spotlight on Latin American residency programs, which combine affordability with access to dynamic markets.

Southeast Asia: From Outsourcing to Innovation

Southeast Asia’s momentum shows no signs of slowing:

- Philippines (5.5%) benefits from remittances and a flourishing outsourcing sector, but also from a young, tech-driven population.

- Vietnam (5.2%), described in the IMF’s 2025 Article IV Consultation, is evolving from a manufacturing hub into a global logistics and investment magnet. The World Bank projects 5.8% growth in 2025, underscoring its resilience.

- Indonesia and Malaysia (4.8% each) leverage natural resources and ambitious infrastructure projects to draw capital inflows.

For investors, Southeast Asia is no longer “emerging”. It is a central pillar of the global economy.

The UAE grows at 4.0% in 2025, powered by diversification into tourism, finance, and technology.

Middle East & Africa: Diversification in Action

The UAE (4.0%) and Saudi Arabia (3.6%) illustrate the benefits of bold diversification strategies, expanding beyond oil into finance, tourism, renewable energy, and technology. Egypt (4.0%) is harnessing its geographic position and the Suez Canal to drive construction and trade.

Africa presents a more varied picture: Algeria (3.5%) benefits from hydrocarbons, while South Africa (1.0%) struggles to overcome systemic constraints. Still, the continent’s youthful demographics suggest long-term potential.

Eastern Europe outpaces Western Europe in 2025, with Poland and Turkey showing stronger growth while Germany and Austria stagnate.

Europe: The East Rises as the West Slows

Europe reveals a stark contrast. Eastern economies like Poland (3.2%) and Turkey (3.0%) remain attractive for manufacturing and technology investment. Meanwhile, Western Europe slows: Germany (0.1%) teeters on stagnation, Austria (-0.5%) contracts, and France (0.6%) underwhelms.

Southern Europe performs better: Portugal (2.0%) and Spain (2.5%) leverage tourism and FDI inflows, particularly through Golden Visa programs. For global investors, European RCBI remains less about growth potential and more about lifestyle, education, and Schengen mobility.

North America: Slowing but Secure

- United States (1.9%) growth cools as the Federal Reserve maintains tight policy, but America remains the world’s anchor economy.

- Canada (1.6%) balances modest growth with strong immigration inflows, keeping its labor force dynamic.

- Mexico (0.3%) lags behind, highlighting competitiveness challenges.

For investors, U.S. EB-5 programs and Canada’s Start-Up Visa remain highly sought after, even as growth moderates.

China grows at 4.8% in 2025 while emerging Asian economies like Vietnam, India, and the Philippines outpace regional giants.

China, Japan, and South Korea: Asia’s Mature Giants

China (4.8%) delivers steady growth, though the IMF warns of risks from its property sector and demographics. Japan (0.7%) and South Korea (0.8%) continue to struggle with structural issues, their growth profiles muted compared to Southeast Asia’s dynamism.

This contrast underscores why emerging Asia is outpacing developed Asia, a critical shift for global investment strategies.

Why It Matters for Investors and Global Citizens

For readers of The Immigration Magazine, these numbers are not abstract. They frame real decisions:

- Where to invest capital for long-term returns.

- Which countries’ residency or citizenship programs align with growth potential.

- How to balance stability (in the West) with opportunity (in emerging markets).

The takeaway is clear: emerging markets are the growth frontier of 2025–2030. India, Vietnam, Argentina, and the Philippines are not just stories of GDP — they are signals of where wealth, mobility, and influence are headed.

References

- IMF World Economic Outlook, April 2025

- IMF World Economic Outlook Update, July 2025

- IMF Article IV Consultation: Vietnam 2025

- World Bank Global Economic Prospects

- World Bank Vietnam Country Overview

Editorial By The Immigration Magazine Team